The Trump administration has not typically put a premium on transparency or fealty to empirical fact. So it was somewhat puzzling when the Department of Energy released its long-awaited study of power grid reliability in August and it looked … mostly normal.

By all accounts, DOE’s experts were allowed to work on it unimpeded. Its conclusions lined up with the broad consensus in the energy field: The loss of coal plants has not diminished grid reliability; in fact, the grid is more reliable than ever. Reliability can be improved further through smart planning and a portfolio of flexible resources. Regulators should work on ways to better compensate reliability in competitive energy markets.

The summary bits of the report added a bit of political spin, but the analytic work and core conclusions were solid — and very much not in line with the administration’s position, which is that reliability is immediately threatened and coal and nuclear plants are necessary to preserve it.

Where, wondered the more cynical observers [waves], was the hackery? Where was the political interference to prop up a favored industry, the blithe disregard of expert knowledge? This is not the Trump administration we’ve come to know and … know.

Well, it turns out, we just needed a little patience. The hackery has landed. Repeat: The hackery has landed.

Unfortunately, the hackery comes obscured by a thick cloak of acronyms — it’s an NOPR from DOE about ISOs that contradicts NERC, FFS — so it takes a little unpacking.

Here’s the short summary: Perry wants utilities to pay coal and nuclear power plants for all their costs and all the power they produce, whether those plants are needed or not.

That may sound a little blunt and ridiculous to you, but don’t worry. Once you understand some of the background and the technical details, you will see that it is in fact more blunt and ridiculous than you could have imagined.

DOE has lurched, on this subject, from minimum to maximum hackery. Even in our new Trumpian world, it is astounding.

Let’s walk through it.

DOE to FERC: address a crisis we determined does not exist

Remember, the administration’s position is that, as Perry put it in his memo requesting a grid study, “regulatory burdens, as well as mandates and tax and subsidy policies, are responsible for forcing the premature retirement of baseload power plants.”

Suffice it to say, he’s not referring to the regulations, mandates, tax, and subsidy policies that benefit coal and nuclear plants. He means renewable energy subsidies, which he says “create acute and chronic problems for maintaining adequate baseload generation and have impacted reliable generators of all types.”

Putting it more explicitly, the administration’s claim is twofold: First, that power plants with large amounts of fuel on-site — coal and nuclear, basically — are necessary to grid reliability, and second, that those plants are unfairly being driven out of business by subsidies to renewable energy.

The problem is, neither claim is true, which poses something of a dilemma for Perry, who has been put in charge of an agency filled with genuine technical experts. And sure enough, DOE’s grid study found, as many other studies before it have, that a) the loss of coal and nuclear plants has not diminished reliability, and b) it is cheap natural gas, not renewable energy subsidies, that has driven coal and nuclear out of business.

Whether through ignorance or cleverness, Perry stumbled on a different communications strategy. He seems to have realized that he didn’t need to mess with the study at all. Why bother? He could simply pretend that it supported the administration’s position. The media would he-said, she-said it for a day or two and then move on. He simply behaved as though the study had confirmed his claims.

Which brings us to last Friday, when DOE proposed a new rule for the electricity system, premised on the very suppositions its own grid study disproved. To wit:

The resiliency of the nation’s electric grid is threatened by premature retirements of power plants that can withstand major fuel supply disruptions caused by natural or man-made disasters and, in those critical times, continue to provide electric energy, capacity, and essential grid reliability services. These fuel-secure resources are indispensable for the reliability and resiliency of our electric grid — and therefore indispensable for our economic and national security. It is time for the Commission to issue rules to protect the American people from energy outages expected to result from the loss of this fuel-secure generation capacity.

Again, this is all wrong. Having fuel on-site does little for resilience. The plants are not indispensable. No one expects energy outages if baseload plants continue closing.

Nonetheless, based on these faulty premises, DOE issued a Notice of Proposed Rulemaking (NOPR) to the Federal Regulatory Energy Commission (FERC), suggesting that FERC adopt a rule forcing utilities in competitive energy markets to pay the full cost of plants that have 90 days’ worth of fuel on-site.

This is a deeply messed-up thing to do, on so many levels it’s difficult to know where to begin. It is the crudest imaginable intervention on coal’s behalf.

But let’s start with a quick note on the authorities involved here.

FERC will determine the fate of this monstrosity

When Congress consolidated various agencies into DOE with the Department of Energy Organization Act of 1977, it deliberately maintained a separate regulatory authority (the Federal Power Commission, renamed FERC).

A quirk of the law allows DOE to propose rules to FERC — an authority is has used only rarely, and for fairly small matters.

Previous uses of DOE’s authority to propose rules to FERC: (1) 1985, DOE proposal addressing problem of “new gas” vs. “old gas” prices…

— Joel B. Eisen (@joeleisen) September 29, 2017

But FERC is independent. It is not under DOE’s authority and does not have to do what DOE proposes.

It is highly unlikely to adopt this rule as-is. (It would effectively be impossible, for reasons we’ll discuss.) But it’s also unlikely to ignore the NOPR. These are, after all, both Trump administration agencies, run by Trump appointees.

So what exactly FERC does with the NOPR — what balance of expertise and hackery it brings to bear — will determine the actual impacts of this thing.

Now, let’s go deeper into the proposal.

Competitive energy markets work fine. Perry’s rule would lob a grenade into them.

In the 1990s and 2000s, around half the electricity markets in the country were “deregulated” — those markets now contain roughly two-thirds of total US electricity demand. To understand Perry’s proposal, we have to understand how those deregulated markets work.

Traditional power markets (all of them, until the turn of the century) are fully regulated, or “vertically integrated.” The utility has a monopoly over a territory and oversees everything in it — it buys all the power (sometimes from power plants it owns) and runs the distribution system.

Every few years, the utility makes a “rate case” before a public utility commission (PUC), projecting demand for coming years and making a case for the resources it needs to build to meet that demand. If the PUC accepts the rate case, the utility is guaranteed back all the money it invests in building infrastructure, plus a “reasonable rate of return.” (If you think this gives the utility incentive to inflate demand expectations and build unnecessary stuff, you are correct.)

This model is called “cost recovery,” because the owner of the power plant is guaranteed recovery of all the fixed costs involved in building and running the plant. Remember that term, it comes up later.

In “deregulated” markets, utilities still typically have a monopoly over the retail side of electricity — distribution, billing, etc. (There are deregulated retail markets too, but let’s not get too complicated.) But the power production side is spun off into competitive markets.

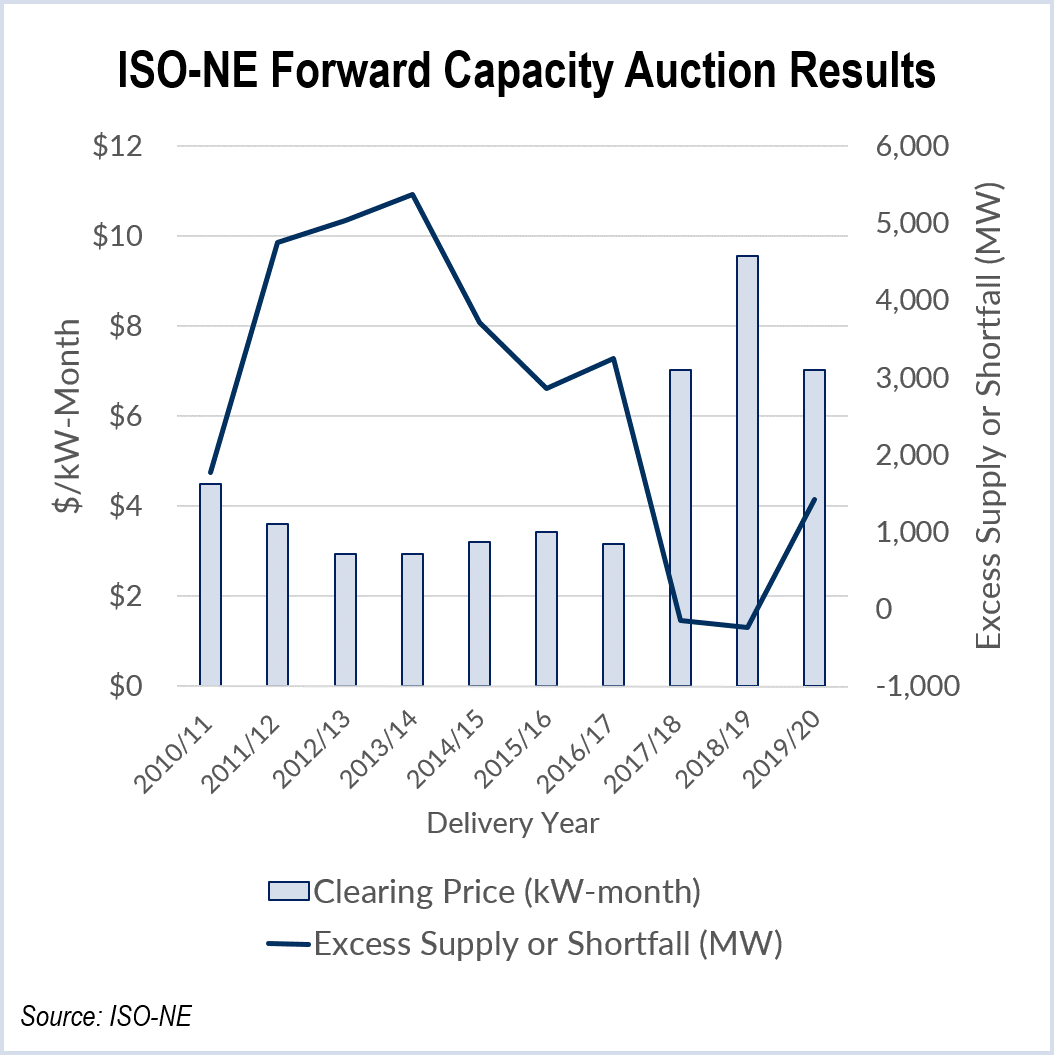

Independent System Operators (ISOs) in these markets hold auctions; power generators bid their power in. The bidder with the highest marginal price sets the “clearing price.” Utilities buy power at that rate and sell it to their customers at a markup. These auctions are typically run daily.

One final technical note: Some energy markets, most notably Texas’s, are “energy only,” which means only electricity itself is bought and sold. But in many other markets, there are also auctions for other, nonpower grid services — for capacity (basically, the ability to spin up in the case of unforeseen need) or for “ancillary services,” things like voltage regulation and flicker control (don’t ask). These nonpower auctions come up later too.

Okay, so, here’s what Perry is proposing: He wants ISOs to implement a cost-recovery model inside competitive markets, but only for coal and nuclear plants.

To wit:

Each Commission-approved [ISO] shall establish a tariff that provides a just and reasonable rate for the (A) purchase of electric energy from an eligible reliability and resiliency resource and (B) recovery of costs and a return on equity for such resource dispatched during grid operations.

In other words, if you’re a power plant owner in one of these markets, you’re on the hook for all your own costs — you only make money to the extent you offer competitively priced power or other services — unless you stockpile 90 days of fuel on site. In that case, you will be compensated for all your electricity and all your fixed costs, plus a rate of return, whether or not your power is competitive in auction. Your profits are guaranteed.

(At least, that’s what it appears to mean. As we’ll discuss later, it is so vague and short on details that there’s plenty of room to interpret.)

It’s hard to overstate how radical this proposal is. It is wildly contradictory to both the spirit and practice of competitive energy markets. It amounts to selective re-regulation, but only for particular power sources, which wouldn’t have to compete, they’d just have to have piles of fuel.

By enabling *full* recovery of costs, @ENERGY‘s proposed Grid Resilience rule is an effective “nationalization” of certain at-risk units

— Jason Burwen (@jburwen) September 29, 2017

It would, in the words of flabbergasted energy experts like former FERC Chair Jon Wellinghoff, “blow the market up.”

This is Travis Kavulla of the Montana PUC, formerly president of National Association of Regulatory Utility Commissioners (NARUC):

Former FERC commissioner Nora Mead Brownell (a Republican) told RTO Insider that the proposal is “the antithesis of good economics. It’s going to destroy the markets [and] drive away investment in new, more efficient technologies.”

It’s not even necessary on its own terms. Perry argues that certain “attributes” of power plants are not fairly compensated, but remember, there are already competitive auctions for non-power services in energy markets. DOE theoretically could have suggested that “fuel assurance” (its term for the attribute of having big piles of fuel around) be compensated at auction. That would be a dumb idea (fuel assurance is immaterial to resilience and reliability, as we will see), but at least it would be in the same universe as existing markets.

Also, ISOs already sign what are called “reliability must-run” (RMR) contracts with certain power plants, insuring that they are always available in case of unforeseen need. There are already tools to do this.

Instead of building on them, DOE has delivered a ham-handed blow to well-functioning energy markets. And it’s all being done, remember, based on the premise that “fuel assurance” is necessary to grid reliability — in fact, that grid reliability is in immediate threat and only giant piles of fuel can save it.

That’s all wrong.

“Fuel assurance” has nothing to do with reliability. And grid reliability is improving anyway.

Perry says the resilience and reliability of the grid are “in jeopardy.” As it happens, the North American Electric Reliability Corporation (NERC), which is charged with monitoring the reliability of the grid based on a wide range of metrics, issues annual reports on this subject. According to its 2016 State of Reliability report, the reliability of the US power system was adequate in 2016, as it has been for years.

As E&E notes, NERC’s Gerry Cauley has testified before FERC on this very matter, in June. He said that “the state of reliability in North America remains strong, and the trend line shows continuing improvement year over year.”

DOE’s own grid reliability report agrees that grid reliability is steadily improving “due to better planning, market discipline, and better operating rules and standards.”

Given that reliability is well-defined — and well in hand — Perry often shifts to “resilience,” a poorly defined and poorly studied quality that he does nothing to clarify. Resilience, roughly speaking, is the grid’s ability to bounce back after disruptions.

Perry makes much of NERC’s warning that “premature retirements of fuel-secure baseload generating stations reduces resilience to fuel supply disruptions,” but if you look at that language closely, it’s practically a tautology. Insofar as the grid is dependent on a single fuel, and there aren’t big piles of that fuel sitting next to power plants, it is more vulnerable to disruptions in the supply of that fuel. Obv, as the kids say.

But that leaves the important questions unanswered. What’s the cheapest way to increase grid resilience? And how much does on-site fuel really improve it?

In support of his fuel-assurance argument, Perry cites the 2014 Polar Vortex, when record low temperatures almost caused blackouts in the US Northeast. But as Robbie Orvis and Mike O’Boyle of Energy Innovation show in a righteously devastating post, that doesn’t mean what Perry thinks it means:

[T]he NOPR conveniently fails to mention that nearly 14 gigawatts (GW) of coal capacity was forced offline during the Polar Vortex, roughly 25 percent of all coal capacity in [the Northeast energy market]. 1.4 GW of nuclear was forced offline as well. Most of these generator outages were due to temperatures below the operating limit of power plant equipment. While some unavailable capacity during the vortex was due to natural gas shortages, particularly in the Northeast, the gas constraint was secondary to cold-weather related outages. Additional coal capacity was unavailable due to frozen coal piles.

Frozen coal piles!

So coal and nuclear didn’t exactly shine under stress. What did?

[T]wo resources did over-perform and helped avoid blackouts: wind and demand response. As PJM’s Polar Vortex assessment states unequivocally, “demand response, although not required to respond during the winter this year, did respond and assisted in maintaining the reliability of the system… PJM also saw up to 4 GW of peak load met by wind power during the Polar Vortex… more than the amount grid operators had calculated was possible under those conditions. The wind power produced had a positive impact on supply and contributed to PJM’s ability to maintain reliability.”

Demand response (i.e., smart management of power demand) and wind proved crucial to resilience, to the grid performing under stress as the cold took big power plants offline. But under Perry’s proposal, they wouldn’t get anything for it. All those shut-down coal plants with the frozen coal piles, however, would be made in the shade.

Orvis and O’Boyle tell a similar story about Hurricane Harvey, which left giant piles of coal in Texas “so soaked with water that they were unable to be transported to the boiler at coal plants, forcing those plants to switch to burning natural gas.” Also, both coal and nuclear plants had to be evacuated during Hurricane Harvey and Irma, which stopped them from running, fuel piles notwithstanding.

In 2016 and 2017, California lost a huge chunk of its supply of natural gas (Aliso Canyon) just as it faced record heat waves. The grid proved resilient “thanks in part to robust demand response programs, renewables, and energy storage that provide capacity during the heat waves.”

Sun, wind, energy storage, and demand management — these are the sources with the shortest, least vulnerable supply lines, the ones most likely to bounce back after disasters. Having big piles of coal around has not proven similarly helpful.

Regardless, the main cause of blackouts is not the temporary unavailability of particular power generators, but damage to the transmission and distribution system — to power lines. That’s why Puerto Rico, which gets 98 percent of its power from fossil fuels, is in such bad shape. That’s why smarter grid planning and management, including microgrids, have more to do with resilience and reliability than any particular power source.

In short, fuel assurance — having lots of power plants with big stockpiles of fuel on-site — has virtually nothing to do with overall grid resilience or reliability.

What’s next: FERC digests this hairball

Aside from its misguided content, the proposal is also absurd on a formal level.

DOE’s proposal is flimsy: factually unsupported, analytically flawed, and legally deficient. It cannot be a basis for a final rule.

— Ari Peskoe (@AriPeskoe) September 29, 2017

First off, the foundation of any proposed rule change to FERC is a case that current rates are not just and reasonable (thus making the change necessary). DOE’s NOPR does absolutely nothing — zilch — to make that case.

Burden is on FERC to show current market rules are unjust and unreasonable and that the proposed rules are just and reasonable.

— Norman C. Bay (@NormanCBay) October 3, 2017

Second, for such a radical change in US electricity markets, it is comically short on details. Do baseload plants with 90 days of fuel get paid only while they maintain those stockpiles, or always? Are they getting their costs covered when producing power, or always? Does reliable sunlight or wind count as stored fuel? Do all nuclear plants automatically qualify, since they typically refuel on more-than-90-day cycles, or is it only when there’s more than 90 days of uranium left? No one knows.

As Ari Peskoe, a senior fellow in electricity law at the Harvard Law School Environmental Law Program Policy Initiative, noted on Twitter, the Administrative Procedure Act (APA), under which Perry is justifying this intervention with FERC, is very clear about what’s required: a proposed rule must “provide sufficient factual detail and rationale for the rule to permit interested parties to comment meaningfully.”

This proposal … does not. As Peskoe told me bluntly, “this looks nothing like a FERC proposal.” This is more like hand-waving in the direction of a rule, with instructions to FERC to make it into something.

“I would set [the NOPR] over to the side someplace under a pile of papers,” Wellinghoff told Utility Dive, “because it would be something that I wouldn’t even consider or entertain.”

Third, Perry’s proposed timeline — for FERC to issue a rule within 60 days — is ludicrously short. FERC rulemaking can easily take six months to a year, and that’s for rules much less radical than this.

There is basically no way FERC can take this skeleton of a proposal and make it real in 60 days.

However. FERC now has three commissioners (a quorum), two of which, including the chair, are Trump appointees. New chair Neil Chatterjee was a staffer for Sen. Mitch McConnell, a noted champion of coal. Chatterjee recently said, “I believe baseload power should be recognized as an essential part of the fuel mix. … I believe that generation, including our existing coal and nuclear fleet, needs to be properly compensated to recognize the value they provide to the system.”

So he’s broadly sympathetic to the administration. (Obviously, or he wouldn’t have been appointed.) And he is already showing Trumpian tendencies, denying a request from 11 trade associations — including several oil and gas groups — for a longer (read: normal) comment period on the proposal. [Correction 10/4/17: Oops, this is wrong. FERC issued its timeline just as these 11 groups were submitting their request; the former is not a response to the latter. As of this writing, FERC has still not ruled on the request.]

Perry justifies the accelerated timetable by referencing emergency powers in the Administrative Procedures Act, but as the trade-association letter notes, “no emergency exists that would justify such an action.”

Nonetheless, FERC is fast-tracking the proposal; it says initial comments are due by October 23 and final reply comments on November 7.

FERC cannot make a serious rule out of this proposal in 60 days, but Peskoe suggests that it might take the proposal as a suggestion or starting point to develop a real rule; it might try to file the proposal into another docket, maybe a rule on price formation; it might simply develop its own rule and call it DOE’s.

That process will depend on just how hackish and partisan FERC is willing to get. Its mandate is to ensure just and reasonable rates, through competition. That implies that it should be creating rules to value grid services, not particular technologies or sources. Defining resilience in such a narrow way — fuel assurance rather than, say, demand response, on-site storage, local generation, or grid hardening — and compensating it in such grossly noncompetitive fashion pretty clearly violates the spirit of FERC’s mission. It might also violate the letter.

“If this rule allowing for cost recovery were to proceed as written,” O’Boyle told me over email, “it’s hard to imagine it would survive [legal] arguments that it was arbitrary and capricious, given all the evidence available that shows fuel availability doesn’t improve resiliency on its own.”

“Arbitrary and capricious,” in this case, means “against the law.”

So FERC will have to do something that a) passes legal muster, b) checks out with the energy experts on its staff, and c) satisfies the political demands coming down from Trump through Perry. And it will have to do so quickly.

I’m not sure what that will, or even could, look like. But you could not ask for a clearer test of how far the rot has penetrated. Trump is contemptuous of facts and experts, determined to aid his supporters and backers, and utterly insensate to any kind of transpartisan standards of conduct or inquiry.

That’s the example being set at the top, and we can see it filtering down, every day. DOE seemed to resist for a while, but Perry has thrown its credibility to the wind with this proposal.

Will FERC resist? Will it work to define resilience in a technology-neutral way, based on attributes and services rather than specific sources? Will it integrate resilience — along with other non-market desiderata, like carbon emissions — into energy markets in a way that preserves competition and innovation?

Or will Chatterjee, like Perry, simply find some pretext to hammer the square peg of coal into the round hole of energy markets that no longer need it?

Further reading

- Alison Silverstein, who “organized the research and drafted the bulk of the technical portions” of the DOE grid study, has a fantastic piece that reviews some of the findings, clarifies why baseload plants have been closing, and offers some smart policy recommendations. (The entire piece is a rebuke to Perry’s NOPR, though very gently and politically put.)

- Gavin Bade at Utility Dive talks to several experts aghast at the NOPR.

- Sam Mintz and Hannah Northey of the always reliable E&E have a nice primer.

- Matt Kasper at the Energy and Policy Institute has a good piece on some of the people, institutions, and money behind the decision.

- Devin Hartman at the conservative R Street Institute highlights the anti-competitive aspects of the NOPR.

- As mentioned, the piece from Robbie Orvis and Mike O’Boyle is particularly satisfying.

- Bloomberg’s Liam Denning writes an incisive critique of the rule with an apt headline: “This coal power subsidy is nuts.”

Nuclear addendum

I know some people are going to ask why I didn’t discuss nuclear specifically. Doesn’t it deserve to be compensated for what it offers the grid? (That’s the subject of big fights in New York and elsewhere.)

Nuclear plants would definitely benefit from Perry’s rule. Since they more or less always have 90 days of fuel on site, and their operating expenses are lower than coal plants’ once they are running, this rule would effectively have all of them always running.

Insofar as that provides the grid with low-carbon power, that’s a good thing. (Better nuclear than coal, always.)

However. What nuclear plants provide the grid, and deserve to be paid for, is low-carbon power. If Perry wants to establish a rule offering cost recovery to low-carbon generators — or, more sanely, if he wants low-carbon to become a valuable attribute in energy-market auctions — I’d be delighted.

But subsidizing nuclear plants for the phantom benefits of fuel assurance is an ugly, ineffective way to keep them running, and it would set a terrible precedent.